New Delhi: Markets were nervous and highly volatile on the back of global tensions between Ukraine and Russia. There has been an unprecedented rise in prices of crude and gas and many other commodities. Some of the Middle East countries are worried about food supplies as they import wheat from these two countries. They fear that they will run out of stock in the next two months if nothing is done.

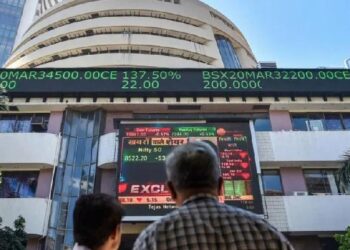

BSESENSEX lost 1,524.71 points or 2.73 per cent to close at 54,333.81 points. NIFTY lost 413.05 points or 2.48 per cent to close at 16,245.35 points. In the process both benchmark indices made new lows, breaking those made on the previous Thursday (24th February) when hostilities broke out. The new lows were 53,887.72 points on BSESENSEX and 16,133.80 points on NIFTY. The broader markets saw BSE100, BSE200 and BSE500 lose 2.27 per cent, 2.22 per cent and 2.06 per cent respectively. BSEMIDCAP lost 2.35 per cent while BSESMALLCAP lost 0.62 per cent.

The Indian Rupee was volatile and under pressure and lost 87 paisa or 1.16 per cent to close at Rs 76.16 to the US Dollar. Dow Jones ended the week with losses of 443.95 points or 1.30 per cent to close at 33,614.80 points.

Markets have seen many of the leading stocks register 52-week lows in last weeks trading. The top losers in the week were stocks from the auto sector with Maruti losing Rs 1,111 or 13.30 per cent to close at Rs 7,244. On the gaining side were the metal sector and the metal stocks whether they were from steel or others. Many of the PSU stocks also gained as it is expected that they would declare hefty dividends in the remaining period of the financial year and help some of the deficit to be covered from the delayed sale of LIC stake.

The DIPAM secretary had highlighted that the stake sale of 5 per cent could get delayed as global conditions are not the best. Its not just a delay of a few weeks as the DRHP would have to be updated as the same is currently reflecting numbers for the half year ended September 2021. One should expect the company to come with numbers for the period ended December 2021 so that they get a couple of months to bring the issue. This should probably also include a new valuation report of the ’embedded value’ as on December 31, 2021.

While this should give IPO bound companies and waiting on the side-lines to tap the markets some relief, the fall in markets has hit their valuations equally badly as well. Further new rules on IPO subscription would kick in from 1st April which would make IPO’s a little more difficult to subscribe in the HNI segment. The new rules would ensure that for the first fortnight of April, everybody would wait for the first brave heart who taps the market under the new rules.

The conflict between Ukraine and Russia has entered the 11th day and one is not sure how long it will continue. Assuming that things quieten down on this front hopefully in the next couple of days, are we to assume that global markets would be on the rampage? Knee jerk reaction maybe, beyond that not sure. The US is seeing new jobs being created and the number of people getting employed is rising rapidly. This is also fuelling inflation quite rapidly and one is not sure what kind of interest hike the FED would do later this month. As far as inflation is concerned it’s not just a matter with the US but global. The war is not helping matters either and the rise in global fuel prices whether it be crude or natural gas is another cause of concern.

The resolution of matters post Ukraine and Russia settling down will be a tricky affair and need a lot of diplomacy and time to resolve. Further, FII’s continue to remain sellers and have been selling aggressively even on days when the markets make new lows. While domestic institutions have been aggressive buyers and seem to be matching to some extent the selling of FII’s, one wonders why? When one knows the intent of the seller, allow him to sell and when it appears that he is more or less done, start buying. I am not a fund manager but I am trying to give my two bits. Some data points, FII’s sold on a net basis Rs 45,720 crore in the month of February while DIIs bought Rs 42,084 crore. In the current month, FII’s sold Rs 18,614 crore while DIIs bought Rs 12,599 crore. Allow them to sell for a couple of days or maybe a week without matching their sales, and probably they will have completed their sale or get tired selling at such low levels.

Besides the global tension we have national news where elections to the five states will have exit polls being announced on Monday evening. Results will begin from Thursday the 10th March morning onwards. If the results favour the ruling government of the day, there would be some movement in the benchmark indices on the positive side. This event could provide some relief to our markets from global cues.

Coming to what an investor should do in the markets currently. We are overshadowed by global cues and they do not seem to be disappearing in a hurry. While there will be volatile moves based on the events of the day, markets have their hands full with concerns on a variety of fronts. In such a scenario it is best to remain largely on the side lines. Safety would remain by trading only in the large cap stocks where the volatility is less and the comfort much higher. While FII’s have been selling and on selling a particular stock, prices do fall, there is a tendency for the stock to move up once the selling subsides. In other words, buy large cap stocks on large dips and continue to sell on rallies. The financial year ending in just about three weeks away and towards the year-end, expect domestic funds to indulge in NAV propping. In short, trade light and more importantly trade cautiously.

(IANS)