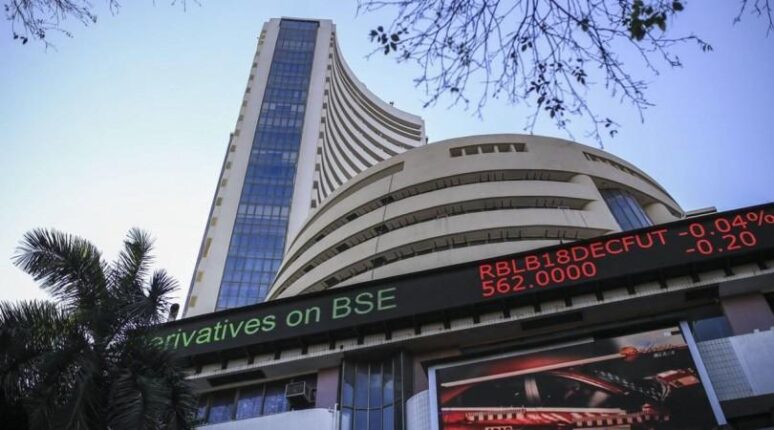

Mumbai: Benchmark indices have erased all its loses and ended marginally higher after the minutes of Federal Reserve’s July meeting signalled a slowdown in the pace of future rate hikes.

At close on Thursday, Sensex ended 37.87 points or 0.06 per cent up at 60,298.00, while Nifty ended 12.25 points or 0.07 per cent higher at 17,956.50.

Kotak Mahindra Bank, Larsen & Toubro, Bharti Airtel and Ultratech Cement, among others, were the major gainers on the BSE.

About 1,900 shares advanced, 1,494 shares declined, while 146 shares remained unchanged on Thursday.

BSE large-cap ended 0.11 per cent up, whereas small-cap and mid-cap closed 0.34 per cent and 0.42 per cent higher, respectively.

“Following the release of the Fed minutes, domestic equities experienced profit booking amid weak sentiment from global peers. The minutes showed that even while decision-makers were concerned about the impact of aggressive actions, they were in favour of raising rates further.

“In the domestic market, IT and pharma were the major laggards, responding to the fall in the US stocks, while financials maintained their support,” said Vinod Nair, Head of Research at Geojit Financial Services.

The minutes of Fed’s July policy showed Fed officials find it appropriate to slow the pace of rate hikes at some point. While most members backed 75 bps rate hike in July, they expressed concerns on overtightening. Additionally, Fed members emphasised the need to gauge the impact of earlier rate hikes on inflation and economic activity.

However, the minutes did not give a clear insight to the quantum of rate hike in September/upcoming meetings, the market revised its rate hike expectations for the September meeting.

Meanwhile, Asian stocks fell on Thursday. The Hang Seng Index sank 0.80 per cent while the Shanghai Composite Index shed 0.46 per cent.

Nifty made a double top compared to the previous session but ended marginally higher. Large volumes and range move mean that a lot of churning seems to be happening between sectors and stocks.

“Going forward, with no reversal signs on the horizon, Nifty could rise towards 18,115 over the next few sessions. On the other hand, a breach of 17,833 could mean faster downsides,” said Deepak Jasani, Head of Retail Research, HDFC Securities.

(IANS)