New Delhi: Globally market participants will be closely watching US Federal Reserve chief Jerome Powell’s comments about the disinflation process in the US and the likely trend in interest rate, says V.K, Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

A 25 bp rate hike, already discounted by the market, will not trigger any market move.

But if the Fed chief indicates that inflation is coming under control and, therefore, no further rate hikes are needed, that will be a big trigger for markets to move up. But such an outcome is highly unlikely since the Fed will play it safe even if inflation is coming under control, he added.

While the range bound movement of the Indian market is likely to continue today, individual stock action in response to results and news will happen.

Q1 results of Tata Motors and their decision to cancel DVR shares and the good results of L&T and the share buy back news are sentient positive, he added.

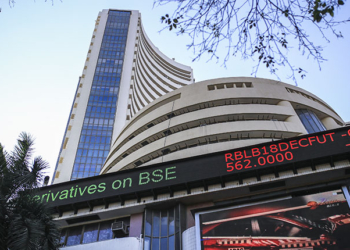

BSE Sensex is up 430 points in morning trade on Wednesday at 66,786 points.

L&T up by more than 3 per cent and Reliance Industries up almost 2.50 per cent are leading the market upmove.

(IANS)