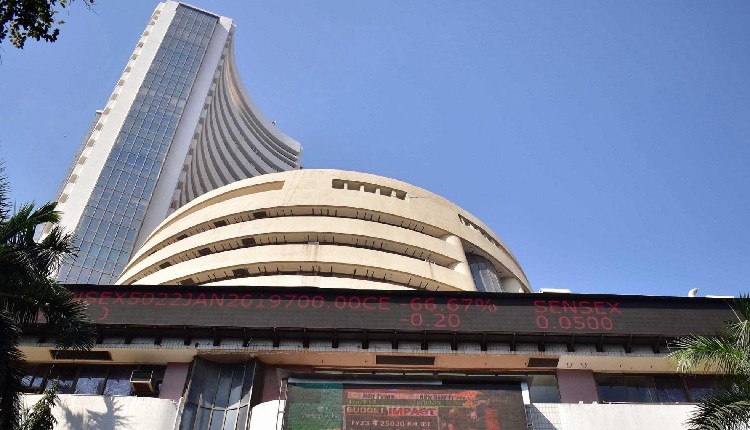

Mumbai: Indian equity indices closed in the green on Tuesday due to a rally in the IT stocks.

At closing, Sensex was up 361 points or 0.44 per cent at 81,921 and Nifty was up 104 points or 0.42 per cent at 25,041.

Buying was also seen in the midcap and large-cap stocks. Nifty midcap 100 index was up 691 points or 1.19 per cent at 59,039 and Nifty smallcap 100 index was up 220 points or 1.15 per cent at 19,317.

Among the sectoral indices, IT, pharma, metal, auto, realty and energy were major gainers. PSU Bank, Fin service and oil gas were major losers.

According to market analysts, “The domestic market showcased a gradual rebound driven by the shift in focus towards upcoming US inflation and potential Fed policy stance. The US political risk and recession fears may set near-term cautious sentiments in the global market. On the domestic front, a strong monsoon, and an expectation of an uptick in demand during festival season will drive investor sentiment.”

In the Sensex pack, HCL Tech, Bharti Airtel, Wipro, Tech Mahindra, NTPC, Power Grid, Axis Bank, TCS, Titan, Infosys, Maruti Suzuki and L&T were the top gainers. Bajaj Finserv, Bajaj Finance, HUL, M&M, Tata Motors, SBI and Reliance were the top losers.

Rupak De, Senior Technical Analyst at LKP Securities said, “Nifty remained volatile throughout the day, unable to sustain levels above 25100. The Relative Strength Index (RSI) remained in a bearish crossover on the daily timeframe, indicating continued weakness.”

“Sentiment is expected to stay weak in the near term unless Nifty manages a close above 25100. On the lower side, support is seen at 24900. If breached, the index may decline further towards 24750,” De added.

The market opened in the green. In early trade, Sensex was up 43 points or 0.05 per cent at 81,605 and Nifty was up 13 points or 0.05 per cent at 24,950.

(IANS)