Mumbai, Aug 25 (IANS) Reserve Bank of India (RBI) Governor Sanjay Malhotra on Monday said that the central bank’s focus on price stability has played a key role in strengthening India’s macroeconomic fundamentals.

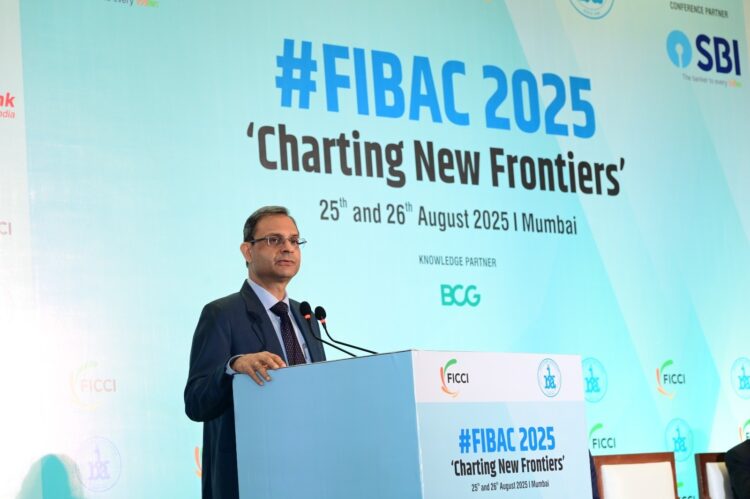

Speaking at ‘FIBAC 2025’, organised jointly by FICCI and IBA, he added that while price stability remains the primary objective of monetary policy, growth has never been lost sight of.

“We will continue to conduct monetary policy with the primary objective of price stability, keeping in view the objective of growth,” Malhotra said, describing financial and price stability as essential for sustainable economic expansion.

The Governor stressed that India is at a critical juncture, navigating a volatile global environment while continuing to stand out as a resilient and hopeful economy.

He urged banks and corporates to work together to revive the “animal spirit” needed to trigger a fresh investment cycle.

“On the demand side, I would urge the industry to invest boldly and champion the entrepreneurial spirit that defines our nation,” he said.

Malhotra also outlined RBI’s efforts to improve ease of doing business. He announced that the central bank is consolidating regulations across categories of regulated entities to create a more principle-based framework.

A new ‘Regulatory Review Cell’ will be set up to examine all regulations every five to seven years, with a focus on efficiency, cost-benefit balance, and alignment with current market realities.

Industry leaders at the event echoed optimism about India’s growth prospects. FICCI President Harsha Vardhan Agarwal said that despite global risks, Indian businesses remain confident about the country’s leadership potential in renewable energy, defence, digital technology, and artificial intelligence.

The event also saw the release of the ‘FIBAC 2025 Knowledge Report’, presented by BCG, which highlighted the strong performance of Indian banks in profitability, asset quality, and valuations over the past few years.

IBA Chief Executive Atul Kumar Goel noted that RBI’s forward-looking initiatives are reshaping the financial sector to foster innovation, resilience, and inclusive growth.

(IANS)