Mumbai: Indian equity benchmarks made marginal losses after hitting record highs and three weeks of consecutive gains due to profit booking. However, the market ended the week in a bullish tone after the Reserve Bank of India (RBI) delivered a 25 bps rate cut that lifted investor sentiment.

Benchmark indices Nifty and Sensex dipped 0.37 and 0.27 per cent during the week to close at 26,186 and 85,712, respectively.

Early optimism driven by strong Q2 GDP print and robust auto sales was overshadowed by persistent FII outflows, sharp rupee depreciation, and uncertainty over trade negotiations.

Broader indices underperformed, with the Nifty Midcap100 and Smallcap100 down 0.73 per cent and 1.80 per cent, respectively in a week.

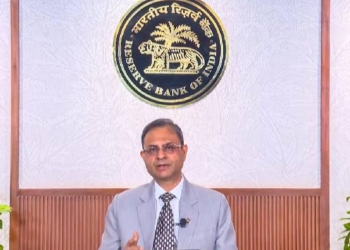

Sentiment reversed on Friday after the RBI surprised markets with a 25-bps rate cut, supported by lower inflation forecasts and liquidity measures.

Gains during the week were led by auto, IT due to festive demand and favourable currency tailwinds. Banks, Finances, consumer durables, power, chemicals and oil & gas lagged.

As long as Nifty sustains above the 26,050–26,000 band, the bullish structure remains valid. Immediate resistance now lies at 26,350–26,500 zone and a break below 26,000 could lead to profit booking, said market experts.

With India’s economic growth remaining resilient despite tariff pressures and global headwinds, the Indian equity market is well-positioned to benefit if global fund flows begin to rotate back into emerging markets, market watchers said.

Investors are keen on cues from the US Federal Reserve’s monetary policy decision next week. Markets have already begun pricing in a 25 bps rate cut, supported by dovish commentary from several Fed officials and recent data pointing to softening labour market conditions.

Analysts said that shift in US Fed’s policy stance could sway currency movements and materially influence foreign portfolio investor flows into emerging markets including India.

(IANS)