Mumbai: Foreign portfolio investors (FPIs) returned to the Indian stock markets in October, reversing three months of outflows — with France as the largest contributor, investing $2.58 billion in equities and almost $152 million in debt, according to NSDL data.

Collectively, FPIs infused over $1.66 billion into equities in October. The US and Germany were also strong buyers investing around $520 million each in equities and contributed approximately $765 million and $309 million, respectively, to debt instruments.

The renewed inflows were supported by robust corporate earnings, the US Federal Reserve’s rate cut, and growing optimism over the possibility of US-India trade talks progressing soon.

Ireland and Malaysia also turned buyers, bringing in $400 million and $342 million into equities, along with $138 million and $68 million in debt. Hong Kong invested $177 million in equities, while Denmark and Norway injected around $100 million each, the data showed.

Singapore recorded an equity outflow of $98 million but offset it with more than $260 million in debt purchases. Other countries collectively sold over $3 billion in October, the data showed.

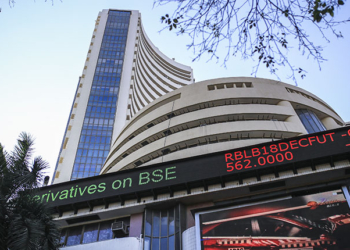

Foreign inflows surged alongside a robust market rally in October, with the Sensex and Nifty each rising 4.5 per cent.

FIIs, however, reversed the trend in the early week of November with analysts warning that significant short selling by foreign institutional investors (FIIs) is outpacing domestic institutional and retail buying.

They noted that the effectiveness of ongoing FII selling and reallocating funds to cheaper markets has encouraged additional shorting. Analysts indicated that short covering might lead to a trend reversal, but no immediate triggers are in sight.

FII selling has reduced the prices of fairly valued large caps particularly in banking and pharmaceuticals where growth prospects continue to be bright, analysts said.

(IANS)