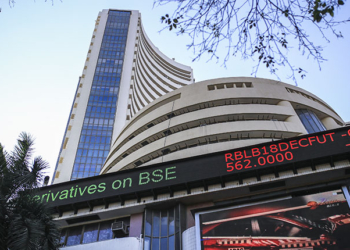

New Delhi: Indian equity markets are expected to remain resilient despite global challenges, supported by strong domestic investor backing and US tariffs having minimal effects, a new report said on Tuesday.

The data compiled by HSBC Global Investment Research gave a ‘neutral’ stance on India, even though it maintained that five out of nine risk factors for Indian markets are improving.

“Tariffs won’t derail the market, as the direct impact on the earnings of listed companies is likely to be muted,” the research firm said. Fewer than 4 per cent of BSE 500 companies depend on US exports, the pharmaceutical sector is exempt from tariffs, reducing earnings risk.

Consumption prospects are improving amid government tax stimulus and easing inflation, it said, adding that wage growth should pick up for a more sustained revival.

Monetary policy is more supportive and can ease the pressure on banks, the largest weight in the listed universe, it said.

“While we find improvements in some of the factors driving equities, we think the upside potential over the near term is still limited,” the statement said.

The earnings growth is expected to moderate to 8–9 per cent in 2025, though the consensus estimate of earnings growth is 11 per cent for calendar year 2025, the brokerage said.

Domestic mutual funds experienced record inflows via systematic investment plans in July. “This is the strongest supportive factor for Indian markets and can be a powerful force even when foreign inflows are muted,” the brokerage said.

HSBC predicted that, though the popular narrative suggests otherwise, both Indian and Chinese markets can perform simultaneously, as both are driven by local investors with limited participation from foreign institutions.

India’s GDP grew by 7.8 per cent in Q1 FY26, maintaining its status as the fastest-growing large economy, driven by services, manufacturing, and favourable monsoon conditions.

(IANS)