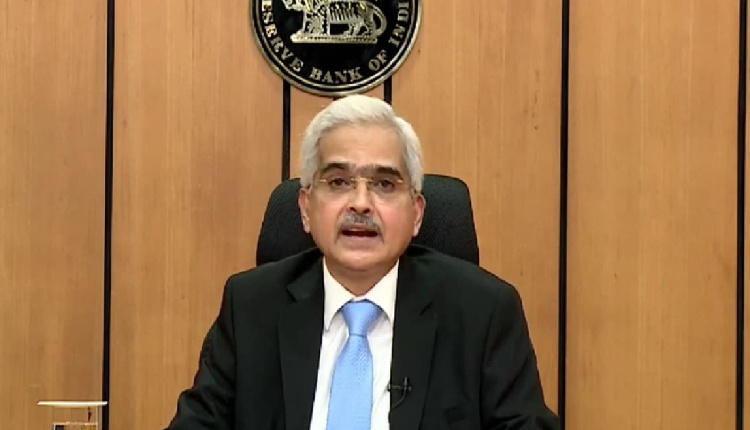

Bengaluru: RBI Governor Shaktikanta Das on Monday offered India’s UPI system as a plug-and-play system for other countries to facilitate quicker and cheaper cross-border remittances among the community of nations.

Addressing the RBI@90 Global Conference here on ‘Digital Public Infrastructure and Emerging Technologies’, the RBI Governor said, “In this journey of attaining harmonisation and interoperability of payments among countries, a key challenge could be the fact that countries may prefer to design their own systems as per their domestic considerations. We can overcome this challenge by developing a plug-and-play system which allows replicability while also maintaining the sovereignty of respective countries.”

“India has made some progress in this direction and would be happy to develop a plug-and-play system for the benefit of the community of nations,” Das announced.

He explained that the UPI system has the potential to evolve into a cheaper and quicker alternative to the available channels of cross-border remittances. A beginning can be made with small-value personal remittances as it can be quickly implemented.

“India is a vast country with great diversity. A solution that works well in India has the potential to be customised to the unique requirements of any other country,” the RBI Governor pointed out.

He said that the conference planners have organised a deep dive session on Day 2 on India’s UPI, especially for the international delegates and requested all delegates to participate and derive benefit from the various sessions and also share their experiences which could provide learnings for all.

Das also highlighted that the theme of India’s G20 presidency in 2023 was ‘One Earth, One Family, One Future’. It underlies India’s thought process in how it sees the world and itself as being part of one family with a common future.

He said that a recurring agenda of importance across all multilateral settings including the G20 and international standard-setting bodies like the Committee on Payments and Market Infrastructures (CPMI) has been to bring efficiency to cross-border payments. A lot of initiatives and experimentation in bilateral and multilateral arrangements among various countries are already underway.

Ideally, while the legacy payment systems should be able to connect to each other, the actual implementation of interoperability would pose challenges and may involve certain trade-offs. Technical barriers may be surmounted by using common (international) technical standards. Further, the governance structure or management framework for long-term sustainability would also need to be finalised, the RBI Governor added.

(IANS)