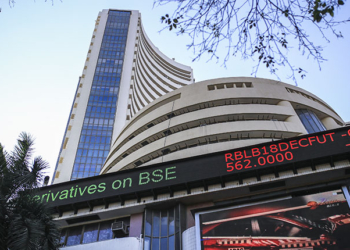

Mumbai: India’s domestic benchmark indices ended higher on Wednesday as the realty sector closed in green after a gain of 1.39 per cent.

Sensex ended at 76,724.08, up by 224.45 points, or 0.29 per cent, and Nifty settled at 23,213.20, up by 37.15 points, or 0.16 per cent.

Nifty Bank ended at 48,751.70, up by 22.55 points, or 0.05 per cent. The Nifty Midcap 100 index closed at 53,899 after climbing 222.50 points, or 0.41 per cent, while the Nifty Smallcap 100 index closed at 17,353.95 after adding 96.15 points, or 0.56 per cent.

According to experts, the domestic market continues to be volatile on account of elevated US bond yields, strengthening dollar, and increasing foreign institutional investors (FIIs) outflows.

“Global markets are cautious ahead of the US December CPI inflation data, which is anticipated to be in the elevated range in the short-term, limiting Federal Reserve’s ability to cut rates. Also, a rise in oil prices & dollar appreciation is likely to affect domestic inflation in the near future,” they said.

On the Bombay Stock Exchange (BSE), 2,152 shares ended in the green and 1,802 shares in the red, whereas there was no change in 110 shares.

In the Sensex pack, Zomato, NTPC, Power Grid, Kotak Mahindra Bank, Maruti Suzuki, Tech Mahindra, L&T, Adani Ports, SBI, HCL Tech, UltraTech Cement, Infosys, Bharti Airtel and Hindustan Unilever Limited were the top gainers. Whereas, M&M, Axis Bank, Bajaj Finserv, Bajaj Finance, Tata Motors, Nestle India, Sun Pharma and Asian Paints were the top losers.

“Another day of choppy trades was witnessed as the market lacked direction. However, sentiment is likely to favour a recovery in the short term, with the potential to reach 23,400 on the higher end,” said Rupak De from LKP Securities.

In the meantime, FIIs sold equities worth Rs 8,132.26 crore on January 14, on the other hand domestic institutional bought equities worth Rs 7,901.06 crore on the same day.

(IANS)