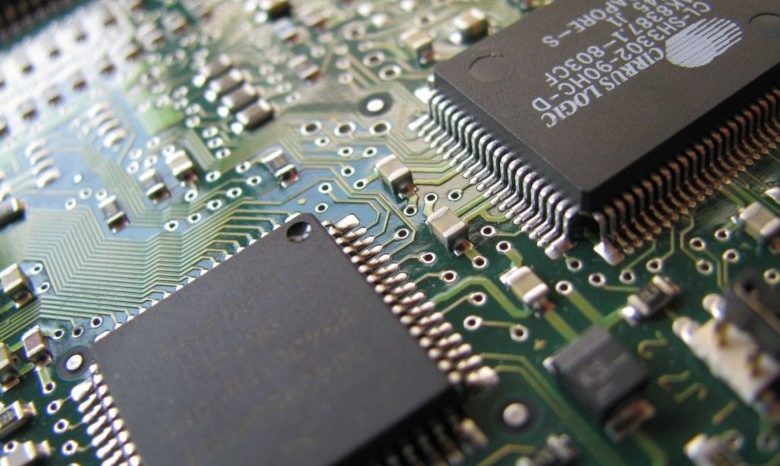

New Delhi: India’s semiconductor component market is likel to reach $300 billion in cumulative revenues by 2026, as ‘Make in India’ and production-linked incentive (PLI) schemes will boost local sourcing of semi-components in the coming years, a new report said on Tuesday.

Mobile and wearables, IT and industrial segments currently contribute around 80 per cent of the semiconductor revenues in the country in 2021.

Further policy reforms and building of a semiconductor ecosystem will reduce reliance on imports going forward, according to the report by the India Electronics & Semiconductor Association (IESA) and Counterpoint Research.

“Before the end of this decade, there will be nothing that will not be touched by electronics and the ubiquitous ‘chip’. Be it fighting carbon emissions, renewable energy, food safety, or healthcare, the semiconductor chip will be all-pervasive,” said Krishna Moorthy, CEO and President, IESA.

The Indian government recently announced an outlay of Rs 76,000 crore (around $10 billion), under its PLI scheme, separately for the development of a semiconductor and display manufacturing electronics ecosystem.

Meanwhile, Maharashtra has beaten at least 5 states to win a stupendous Rs 2.06 lakh-crore investment by Vedanta Group-Foxconn partnership in the sunrise semiconductors chips and display fabrications sector in Pune.

“The gradual shift from feature phones to smartphones has been generating increased proportions of advanced logic processors, memory, integrated controllers, sensors and other components. This will continue to drive the value of the semiconductor content in smartphones, aided by the rise of wearables such as smartwatch and TWS,” explained Tarun Pathak, Research Director at Counterpoint Research.

According to Counterpoint Vice President Neil Shah, the next big boom for semiconductor components will come from across sectors.

“However, the telecom sector with the advent of 5G and fiber network rollout will be a key catalyst in boosting the semiconductor components consumption,” Shah said.

This consumption will not only come from the advanced semiconductor-heavy 5G and FTTH network infrastructure equipment, which will contribute to more than 14 per cent of the total semiconductor consumption in 2026, “but also from the highly capable AI-driven 5G endpoints, from smartphones, tablets, PCs, connected cars, industrial robotics to private networks,” he mentioned.

In 2021, India’s end equipment market stood at $119 billion in terms of revenue. It is expected to grow at a CAGR of 19% from 2021 to 2026.

The electronic system design and manufacturing (ESDM) sector in India will play a major role in the country’s overall growth, from sourcing components to design manufacturing, the report mentioned.

(IANS)