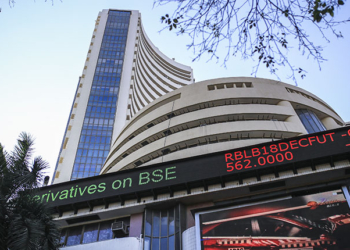

Mumbai: India equity indices closed in the deep red on Thursday amid conflict in the Middle East.

At closing, Sensex fell 1,769 points, or 2.10 per cent, to 82,497 and Nifty fell 546 points, or 2.12 per cent, to 25,250.

In the trading session, the market trend was negative. 2,864 shares were in red, 1,120 shares were in green, and 92 shares closed without any change.

Due to the sharp fall, the market valuation of all the companies listed on the Bombay Stock Exchange (BSE) declined by about Rs 10 lakh crore to Rs 465 lakh crore.

Selling was also seen in the midcap and smallcap stocks. Nifty midcap 100 index fell by 1,333 points, or 2.21 per cent, to 59,024 and Nifty smallcap fell by 378 points, or 1.96 per cent, to 18,952.

Almost all NSE indices closed in the red. Auto, Fin Service, IT, FMCG, Realty, Energy, Private Bank and Infra indices were the major losers. In the Sensex pack, L&T, Axis Bank, Tata Motors, Reliance, Maruti Suzuki, Asian Paints, Bajaj Finance, Wipro, Kotak Mahindra Bank, Bajaj Finserv, Titan, HDFC Bank, HCL Tech and Power Grid were the top losers.

Only JSW Steel closed in the green.

According to market experts, the domestic market took a sharp downturn following Iran’s launch of ballistic missiles at Israel, sparking fears of retaliation and escalation into war. This could potentially drive up oil prices and lead to inflationary pressures, they said. Additionally, new SEBI regulations for the F&O segment have raised concerns about reduced trading volumes in the broader market. Lastly, with attractive valuations in China, FIIs have redirected their funds, adding pressure on Indian stocks, they added.

The foreign institutional investors (FIIs) extended their selling as they sold equities worth Rs 5,579 crore on October 1, while domestic institutional investors extended their buying as they bought equities worth Rs 4,609 crore on the same day.

(IANS)