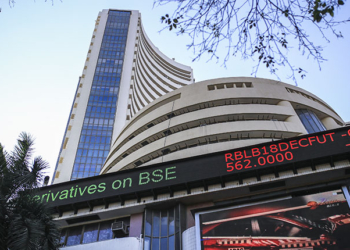

New Delhi: Union Finance Minister Nirmala Sitharaman said on Friday that it is the duty of the Securities and Exchange Board of India (SEBI) to regulate the futures and options (F&O) markets amid concerns over excess volatility in the derivatives segment.

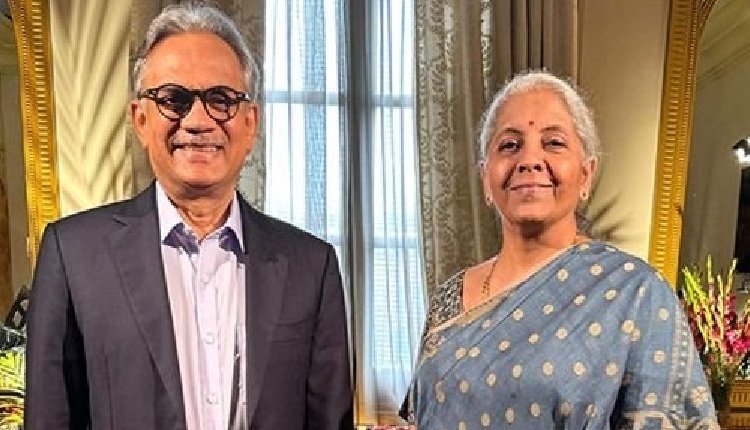

In an interaction with Sanjay Pugalia, CEO and Editor-in-Chief of the NDTV Network, the Finance Minister said: “We believe it is for SEBI to do that regulation in the market, just like they have been voicing concerns about the speculative activity happening in the F&O market.”

In a bid to foster a more stable and mature investment environment, the government, in the Union Budget 2024, has announced an increase in security transactions tax (STT) on futures and options trading.

The Finance Minister said the budget proposal to increase the securities transaction tax on futures and options is to “show the government’s intent to indicate to people the high-risk nature of such markets, and not to raise revenue”.

“We leave it to SEBI to give a soft-touch regulatory approach to F&O and cash markets,” she said.

The Finance Minister also said that there is no sector out of the government’s consideration for foreign direct investment (FDI).

“We have opened and expanded every sector for FDI in the last 10 years. Even the sectors that were already open have seen further expansion,” said the minister.

Regarding FDI from China, Minister Sitharaman said that to her knowledge, “there have been no discussions”.

As petrol and diesel are currently taxed under VAT rather than Goods and Services Tax (GST), the Finance Minister emphasised that for this transition to take place, states must unify and reach a consensus in the GST Council.

“If they fix the rate and they all come together and decide that GST will include petroleum products, then we can implement it immediately,” Sitharaman added.

Currently, the rates of petrol vary from state to state depending on the local incidence of taxation.

(IANS)