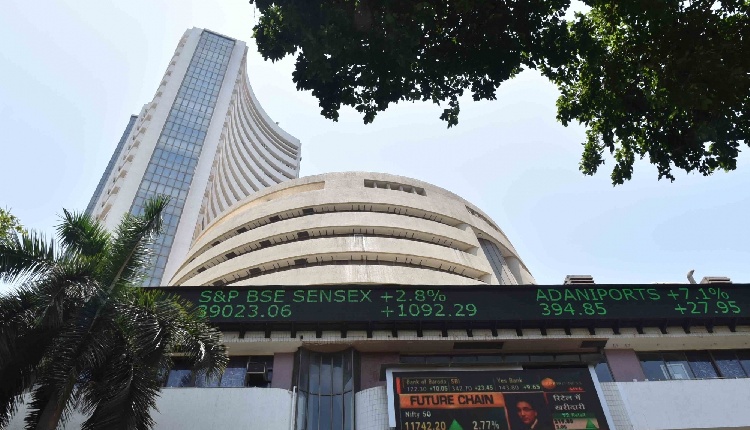

Mumbai: India equity indices ended with weekly gains after two consecutive weeks of losses. Both frontline indices Sensex and Nifty closed in the green led by tech stocks last week.

On Friday, Nifty closed 397.40 points or 1.64 per cent higher at 24,541.15 and Sensex closed 1,330.96 points or 1.68 per cent higher at 80,436.84. This was the highest closing of the main indices after August 2. The market breadth was skewed in the favour of the buyers. Around 2,440 stocks advanced, 1,493 declined, and 97 closed unchanged on the BSE.

On a weekly basis, Sensex railed 0.92 per cent and Nifty surged 0.71 per cent.

Among the sectoral indices, Nifty IT 4.7 per cent; Nifty Realty 2.58 per cent; Nifty Auto 0.99 per cent; and Nifty Oil and Gas 0.21 per cent were major gainers.

However, Nifty PSU Bank 2.15 per cent; Nifty Media 2 per cent; Nifty Energy 1.05 per cent; and Nifty Metal 0.49 per cent were major losers.

In the Nifty pack, Tech Mahindra 5.2 per cent; Wipro 5.1 per cent; Infosys 5.0 per cent; HCL Tech 4.9 per cent; TCS 4.4 per cent; L&T Mindtree 3.5 per cent; Titan Company 3.4 per cent; Mahindra And Mahindra 3.3 per cent; and Tata Motors 2.8 per cent were the top gainers.

Divis Lab 4.1 per cent; Coal India 3.33 per cent; Dr. Reddy’s Lab 3.1 per cent; NTPC 3.1 per cent; Adani Port 2.6 per cent; Power Grid 2.1 per cent; and SBI Life Insurance 2.1 per cent were the top losers.

“The global market sparkled due to better US retail sales data and the decline in weekly jobless claims, which helped to alleviate fears of a U.S. recession. Further, the moderation in US CPI inflation and drop in the US 10-year yield helped the truncated week to close on a positive note. The IT index outperformed by around 5 per cent during the week in expectation of a loose monetary policy from the Fed,” market experts said.

(IANS)