Chennai: Even as the Reserve Bank of India’s (RBI) Monetary Policy Committee has not changed the repo rate from 6.5 per cent, a rate reduction may take even 12 months for that to happen, said experts.

The repo rate is the rate at which the RBI lends to the banks.

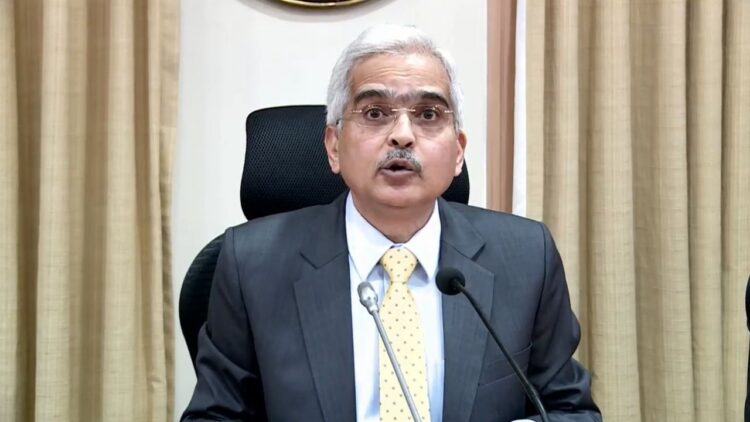

The MPC at its meeting held October 4-6 has forecast inflation for FY24 at 6.5 per cent and its decision was announced by RBI Governor Shaktikanta Das on Friday.

Das said the MPC unanimously decided to keep the repo rate at 6.5 per cent and predicted a gross domestic product (GDP) growth of 6.5 per cent for FY24.

As regards the inflation rate, the MPC forecast was 5.4 per cent for 2023-24 taking into account the various domestic issues including potential agricultural produce.

“The Governor sounded cautious about inflation even though the full-year inflation projection was unchanged. It is to be noted that the Governor reiterated the RBI’s commitment to bring CPI inflation down to 4 per cent target. The RBI kept the GDP growth projection for FY24 untouched as they await additional data points to comprehensively assess the evolving dynamics,” Rajani Sinha, Chief Economist, CARE Ratings said.

Furthermore, the RBI remains watchful of the liquidity conditions and wants to ensure no build-up of surplus liquidity. Hence the governor announced that RBI would consider open market operation (OMO) sale of government securities to mop up excess liquidity as required, Sinha added.

“We expect the RBI to start its rate-cutting journey from the second quarter of next fiscal year as inflation edges closer to 4 per cent target,” Sinha said.

Although RBI expects significant easing of inflation in September, food inflation is expected to remain high. Consequently, a rate cut in the near future remains unlikely. While this may unnerve the bond markets to some extent, the equity markets, though slightly disappointed, have other triggers in the near term to track and worry about, said Dhiraj Relli, MD & CEO, HDFC Securities.

According to Suman Chowdhury, Chief Economist and Head- Research, Acuité Ratings & Research, any possible rate cut may not materialize before the first quarter of FY25.

As to the RBI Governor’s statement, Chowdhury said it puts the spotlight on macroeconomic and financial stability with banks and NBFCs having been urged to monitor the sharp growth in personal loans.

According to the inflation projection, the RBI anticipates persistent headline inflation even in FY25. As per the RBI’s inflation forecast, the real policy rate would be in the 100 to 150 basis point range in FY25, said Sujan Hajra, Chief Economist & Executive Director, Anand Rathi Shares and Stock Brokers

“As a result, a rate cut in the next 12 months is exceedingly unlikely. On the plus side, the governor expressed strong confidence that India will maintain strong growth and that inflation will continue to fall, albeit slowly. These forecasts are encouraging for both the equity and debt markets in the medium term. However, the strong possibility of the RBI remaining on hold for an extended period of time, as well as the continuance of liquidity tightening, is bad for interest-sensitive industries,” Hajra said.

(IANS)