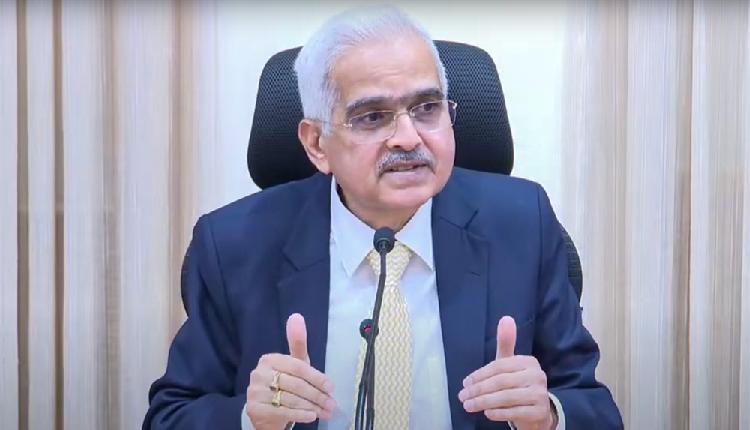

New Delhi: The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) on Wednesday decided to maintain the status quo on the repo rate at the current 6.5 per cent, while retaining India’s real GDP growth forecast at 7.2 per cent for FY25.

RBI Governor Shaktikanta Das said that inflation for the third quarter (Q3) this fiscal is set to moderately increase to 4.8 per cent, saying that moderation in inflation is likely to remain slow and uneven.

“The inflation horse has been brought to the stable within the tolerance band. We have to be careful about opening the gate,” he said during the MPC briefing.

The central bank decided to hold rates steady despite the US Federal Reserve’s recent rate cut of 50 basis points. The RBI has changed the stance to ‘neutral’ from “withdrawal of accommodation”.

“The Indian rupee continues to be among the least volatile currencies,” said the RBI Governor.

He further stated that banks and NBFCs need to give continued attention to inoperative accounts, mule accounts, the cybersecurity landscape and other factors.

Experts welcomed the decision on steady repo rate, saying while there were hopes for a rate cut in line with the US Fed, the RBI has taken a prudent approach by focusing on key indicators like domestic inflation and financial stability, particularly in light of the declining individual savings as a percentage of GDP, which poses a financial stability risk.

“Recent global geopolitical developments have led to a surge in oil prices, which could drive inflation further. This likely influenced the MPC’s decision to hold rates steady,” said Suresh Darak, Founder of Bondbazaar.

Over the last couple of weeks, the 10-year benchmark G-sec yields have risen by around 10 basis points due to these factors.

However, if these global challenges prove temporary, we might see a rate cut in the next policy cycle, said experts.

(IANS)