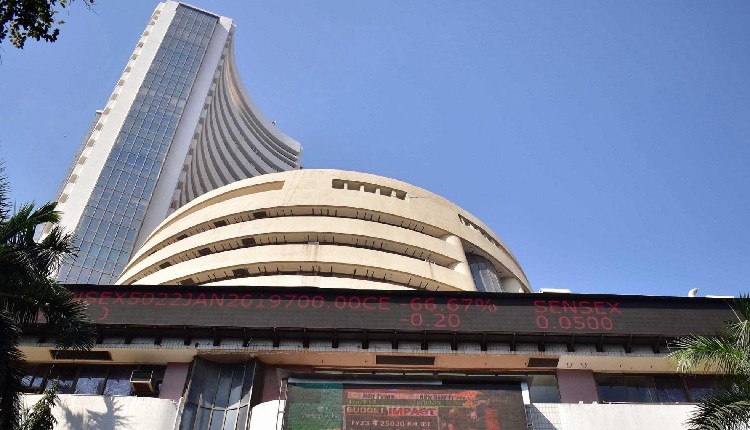

New Delhi: The Indian stock market witnessed a weak trend in the last week due to heavy selling in the largecaps.

In the last week, the combined market cap of six of the top 10 most valued companies eroded by Rs 1.55 lakh.

In the top 10, Reliance Industries (RIL), Bharti Airtel, ICICI Bank, ITC, Hindustan Unilever, and Life Insurance Corporation of India (LIC) were losers. Tata Consultancy Services (TCS), HDFC Bank, Infosys, and State Bank of India (SBI) were gainers.

The market capitalisation of Reliance Industries fell by Rs 74,563.37 crore to Rs 17,37,556.68 crore. The market cap of Bharti Airtel fell by Rs 26,274.75 crore to Rs 8,94,024.60 crore. The market capitalisation of ICICI Bank fell by Rs 22,254.79 crore to Rs 8,88,432.06 crore, and of ITC fell by Rs 15,449.47 crore to Rs 5,98,213.49 crore.

The market cap of LIC fell by Rs 9,930.25 crore to Rs 5,78,579.16 crore and the market valuation of Hindustan Unilever fell by Rs 7,248.49 crore to Rs 5,89,160.01 crore.

The market valuation of TCS rose by Rs 57,744.68 crore to Rs 14,99,697.28 crore. The market cap of Infosys jumped Rs 28,838.95 crore to Rs 7,60,281.13 crore and the SBI’s market valuation rose by Rs 19,812.65 crore to Rs 7,52,568.58 crore.

HDFC Bank’s market valuation has increased by Rs 14,678.09 crore to Rs 13, 40,754.74 crore.

According to the market experts, the weakness in the Indian market can be attributed largely to the relentless selling by FIIs which continues this month, too. After the massive FII selling of Rs 1,13,858 crores in October, FIIs have so far, in November, sold equity for Rs 19,849 crores in the cash market. The rationale for the FII selling is, the elevated valuations in India which appear conspicuous in the context of the earnings deceleration evident in the Q2 numbers, the experts said, adding that the FII selling trend is likely to continue in the near term till data indicate the possibility of a trend reversal.

(IANS)