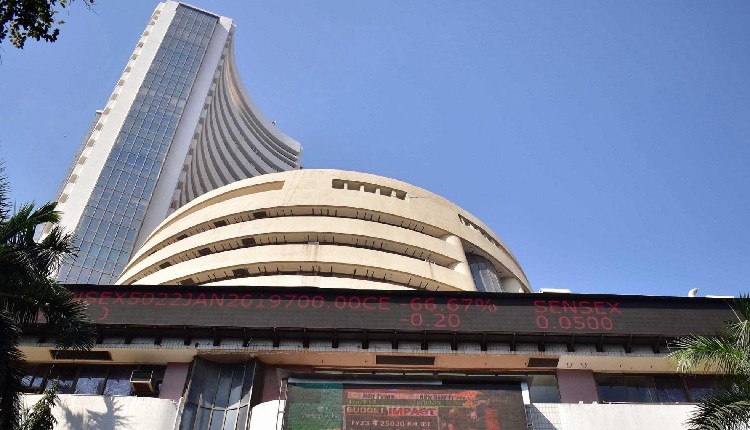

Mumbai: Indian equity indices closed in the green on Monday following positive sentiment in the market due to rate cut expectations arising after the US Fed chair’s comments at Jackson Hole.

At closing, Sensex was at 81,698 with a gain of 611 points or 0.75 per cent and Nifty was at 25,010 with a gain of 187 points or 0.76 per cent.

During the day, Sensex traded in the range of 81,278 to 81,824 and Nifty in the range of 24,874 and 25,043.

Buying was also seen in Midcap and Smallcap stocks. The Nifty Midcap 100 index closed at 58,931, up 375 points or 0.64 per cent, and the Nifty Smallcap 100 index closed at 19,132, up 53 points or 0.28 per cent.

Among the sectoral indices, IT, FMCG, auto, metal, energy, private banks and infra were the major gainers. PSU banks and media were the major laggards.

In the Sensex pack, HCL Tech, NTPC, Bajaj Finserv, Tech Mahindra, JSW Steel, Titan, Wipro, M&M and L&T were the top gainers. Maruti Suzuki, Kotak Mahindra, Nestle, Sun Pharma, HUL, IndusInd Bank and UltraTech Cement were the top losers.

According to the market experts, “US Fed has signalled a rate cut in September which is reflecting in the decline in US treasury yields and the dollar index, which has led to a rally in global markets despite there being no indication of the size of cuts.”

“Indian markets nearly reached a new high led by a change in FIIs stance to positive from negative along with continued strong DIIs inflows. Although the overall trend was positive, large caps outperformed on account of healthy earnings and relatively fair valuation compared to broader markets. IT, Realty, FMCG and Consumption gained on account of improved outlook,” they added.

The foreign institutional investors (FIIs) extended their buying as they bought equities worth Rs 1,944 crore on August 23, while domestic institutional investors also bought equities worth Rs 2896 crore on the same day.

(IANS)