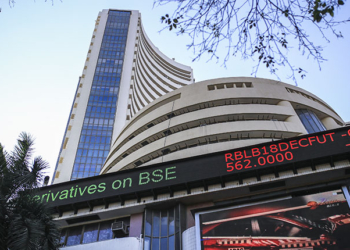

New Delhi: BSE Sensex is down 249 points on Wednesday morning trade as IT stocks face selling pressure.

BSE Sensex is trading at 69,301 points with Infosys, TCS down more than 2 per cent.

Vaishali Parekh, Vice President – Technical Research, Prabhudas Lilladher, said Nifty has been roped in with a tight resistance near 21,000 zone and has witnessed some profit booking during the intraday session to dip towards 2,0850 zone to end in the red near the 20,900 levels.

With near-term support positioned near 20,850 zone, we can expect some consolidation and would need a decisive breach above 21,000 levels to carry on with the uptrend and expect for next higher targets of 21,800-21,900 levels in the coming days with major support lying near 20,550 zone of the rising trendline zone. The support for the day is seen at 20800 while the resistance is seen at 21,050.

V.K. Vijayakumar, Chief Investment Strategist at Geojit Financial Services said the short-term undercurrent of the market is bullish despite the high valuations.

The growth momentum in the economy, the sustained buying by DIIs and retail investors, reversal of the FPI strategy from selling to buying and favourable global cues will keep the market resilient. From the global perspective, tonight’s Fed message is important in setting the global market trend. Markets will wait for the Fed chief’s message before taking a decisive turn.

Even though India’s CPI inflation has come higher at 5.55 per cent in November compared to 4.87 per cent in October, this print is lower than the market expectation of 6 per cent. IIP growth of 11.7 per cent in October indicates continuation of the growth momentum in the economy. Steadily declining Brent crude ( now below $74 ) is strengthening India’s macros.

Leading banks, capital goods, cement, oil marketing companies and the leading airline company are on strong wicket, he said.

(IANS)