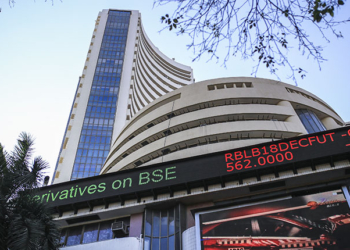

Mumbai: The Indian benchmark indices posted mild losses early on Friday amid rising geopolitical tensions and renewed threats of 500 per cent US tariffs on Indian goods under the provisions of the Russia Sanctioning Act.

As of 9.29 am, Sensex slipped 107 points, or 0.13 per cent to 84,073 and Nifty eased 26 points, or 0.10 per cent to 26,850.

Main broad cap indices posted stronger losses compared to benchmark indices, with the Nifty Midcap 100 down 0.29 per cent, while the Nifty Smallcap 100 lost 0.84 per cent.

ONGC and Bharat Electronics were among top gainers on the Nifty pack. Nifty realty and media were the top losers, down 2.14 per cent and 1.34 per cent, respectively. All sectoral indices were trading in red, except IT and PSU Bank.

Immediate support lies at 25,700–25,750 zone, and resistance placed at 26,150–26,200 zone, market watchers said.

After the sharp correction on Thursday triggered by the possibility of about a 500 per cent tariff on India under the provisions of the Russia Sanctioning Act approved by US President Donald Trump, the market will be focused on the verdict, expected from the US Supreme Court on the legality of Trump tariffs, analysts said.

On Thursday, Nifty extended its losing streak for a fourth consecutive session, falling 263 points to close at 25,876.

Asia-Pacific markets traded mixed in the morning session as investors parsed China’s inflation data which accelerated in December to the fastest pace in nearly three years.

In Asian markets, China’s Shanghai index gained 0.3 per cent, and Shenzhen added 0.57 per cent, Japan’s Nikkei advanced 1.14 per cent, while Hong Kong’s Hang Seng Index dipped 0.07 per cent. South Korea’s Kospi advanced 0.69 per cent.

The US markets were mostly in the green zone overnight even as Nasdaq lost 0.44 per cent. The S&P 500 gained 0.01 per cent, and the Dow moved up 0.55 per cent.

On January 8, foreign institutional investors (FIIs) sold net equities worth Rs 3,367 crore, while domestic institutional investors (DIIs) were net buyers of equities worth Rs 3,701 crore.

(IANS)