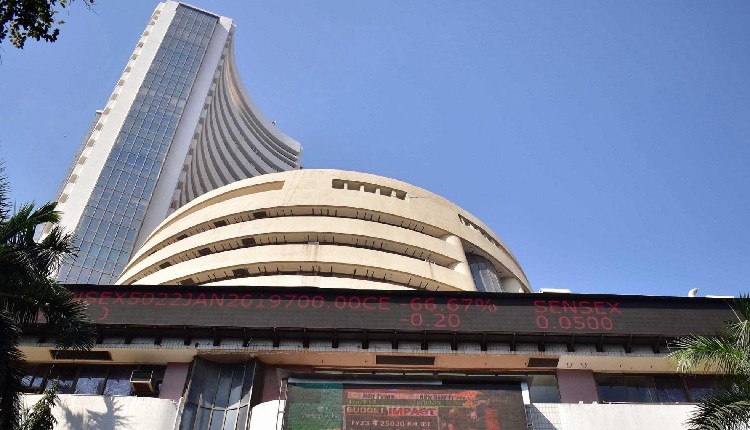

Mumbai: The Indian stock market ended in red on Thursday as Sensex and Nifty were down by more than 1 per cent.

At closing, Sensex was down 1190.34 points or 1.48 per cent to 79,043.74. Nifty was down 360.75 points or 1.49 per cent to 23,914.15.

This decline was led by IT stocks. The Nifty IT index witnessed heavy selling and it was down more than two per cent and closed at 42,968.75

This decline in the Indian stock market aligned with the decline in global counterparts. The decline was seen in the market due to increased concerns over the policies of US President-elect Donald Trump and uncertainty about interest rate cuts in the US.

Midcap and smallcap stocks outperformed the large caps. Nifty Midcap 100 index was up 28.40 points or 0.05 per cent at 56,300.75. Nifty Smallcap 100 index was up 8.70 points or 0.05 per cent at 18,511.55.

On the Bombay Stock Exchange (BSE), 2208 shares closed in green and 1,731 shares in red. Whereas, there was no change in 106 shares.

Market experts said, “The overnight sell-off in the US market, driven by renewed uncertainty about the rate cut trajectory and rising geopolitical tension, led to a correction in heavyweight IT and consumer discretionary stocks.”

“Conversely, the broader market outperformed the frontline index due to a shift in the stance of FIIs and investors seeking opportunities in undervalued stocks,” they said.

On the sectoral indices, IT, auto, financial services, pharma, FMCG, metal, energy, pvt bank, infra, and commodities were major losers. However, PSU Bank, media and realty were major gainers.

In the Sensex pack, except SBI, all the stocks closed in the red. M&M and Infosys were top laggards.

Institutional activity on Wednesday was mixed. Foreign Institutional Investors (FIIs) were net buyers of equities worth Rs 7.78 crore, while Domestic Institutional Investors (DIIs) made net purchases of Rs 1,301.97 crore.

(IANS)