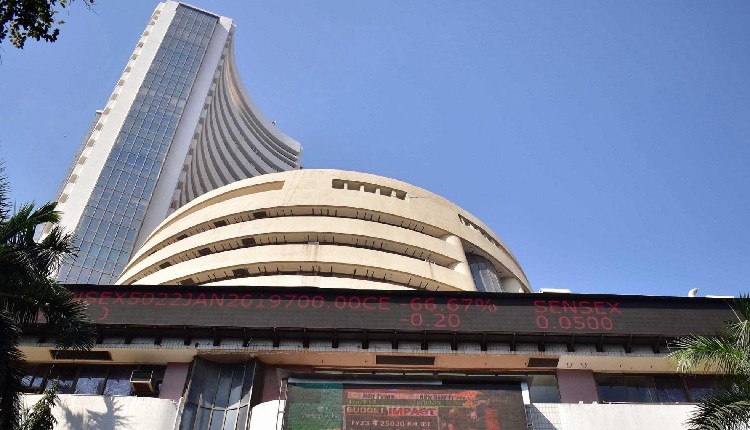

Mumbai: The Indian equity indices closed in red on Thursday amid weak global cues after the US Federal Reserve’s hawkish stance on rate cuts, as with moves towards maximum employment and price stability, its FOMC halved the number of rate cuts expected for 2025.

Sensex closed at 79,218.05 down by 964.15 points, or 1.20 per cent, and Nifty settled at 23,951.70 down by 247.15 points, or 1.02 per cent.

According to market experts, the Indian market saw a widespread decline following a global sell-off driven by the US Fed’s hawkish stance on interest rates. Sectors sensitive to interest rates, such as banking and real estate, significantly bore the brunt.

“However, the Bank of Japan’s decision to keep its interest rate steady, which surprised economists, aided in reducing the selling pressure. Despite this, investor caution persisted amid ongoing FII selling, with a strategic shift towards defensive sectors like pharma as evidenced by their outperformance,” an expert added.

Nifty Bank ended at 51,575.70, down by 563.85 points, or 1.08 per cent. The Nifty Midcap 100 index closed at 58,556.25 after dropping 167 points, or 0.28 per cent.

Nifty Smallcap 100 index closed at 19,133.10 after dropping 97.25 points, or 0.51 per cent.

On the Bombay Stock Exchange (BSE), 1,684 shares ended in green and 2,309 in red, whereas there was no change in 102 shares.

On the sectoral front, heavy selling was seen in the IT, metal and energy sectors of the Nifty at the end of trading. Buying was seen in pharma and healthcare.

In the Sensex pack, Bajaj Finserv, JSW Steel, Bajaj Finance, Asian Paints, ICICI Bank, Reliance, TCS, Infosys, Tata Motors, and M&M were the top losers in the Sensex pack. Sun Pharma, Hindustan Unilever, and Power Grid were the top gainers.

(IANS)