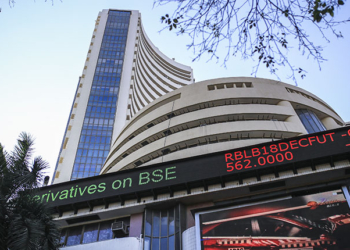

New Delhi: Small and mid-cap indices slumped on Friday in a broad based selling while the bluechip Sensex was flat.

PSU stocks were also down across the board as the broader market showed most of the sectoral indices were down.

BSE small-cap Index was down 2.6 per cent in trade. MSTC was down 15 per cent, AstraZeneca Pharma was down 14 per cent, Surya Roshni was down 10 per cent, RVNL was down 9 per cent, Bector Foods was down 9 per cent, BEML was down 8 per cent, Onmobile Global was down 10 per cent.

BSE mid-cap Index was also down 2.43 per cent with PFC down 10 per cent, GIC Re down 8 per cent, NHPC down 7 per cent, REC down 7 per cent, Ramco Cement down 7 per cent, SJVN down 7 per cent, UCO Bank 6 per cent, IOB down 6 per cent, IRFC down 5 per cent, HPCL down 5 per cent, Patanjali down 5 per cent.

PSU stocks are down heavily with the index down by more than 4 per cent. MTNL is down 8 per cent, KIOCL is down 9 per cent, NBCC is down 8 per cent, SCI is down 8 per cent, Railtel is down 7 per cent, Hindustan Copper is down 7 per cent, IOC is down 7 per cent, Nalco is down 6 per cent, Hudco is down 6 per cent.

V.K. Vijayakumar, Chief Investment Strategist, Geojit Financial Services said when valuations are high the bears will use any negative news to push the market down. The slightly negative news, from the market perspective, came Thursday in the slightly hawkish comments of the RBI Governor.

The good news that the economy is doing better-than-expected and a GDP growth projection of 7 per cent and CPI inflation of 4.5 per cent for FY 25 was ignored. The selling was aggravated with FIIs, too, running with the bears. There is a significant build up in the short position of FIIs. This normally happens along with the rise in the US 10-year bond yields which is now at 4.15 per cent, said Vijayakumar.

FII selling and bear onslaught are unlikely to take the market down significantly. There will be strong buying on dips. The sustained flows into mutual funds which are gathering momentum will enable the DIIs to buy aggressively, he said.

(IANS)