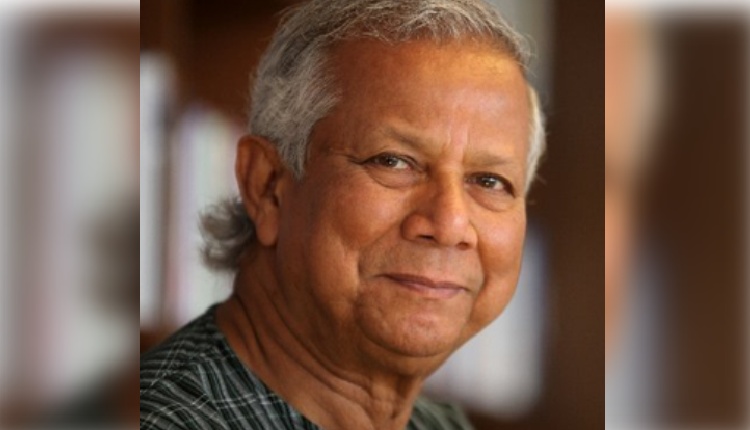

New Delhi: Nobel laureate and microfinance pioneer Muhammad Yunus will take charge as the head of the interim government in Bangladesh late Thursday evening as the country battles its biggest political crisis since gaining Independence in 1971.

That Yunus will be playing a major role in the military-backed interim government was quite evident within hours of former Prime Minister Sheikh Hasina’s resignation and departure from the country on Monday amid massive anti-quota protests that had claimed several lives.

Yunus was attending the Paris Olympics as the country got engulfed in massive unrest and violence. The 84-year-old former banker landed in Dhaka Thursday afternoon, hours before his swearing-in ceremony.

Born on June 28, 1940, in the Chittagong district, Yunus did his schooling at Chittagong Collegiate School before earning a bachelor’s degree in economics from Dhaka University.

He later obtained a PhD in economics from Vanderbilt University in the USA on a Fulbright Scholarship in 1969.

Upon returning to Bangladesh in 1972, Yunus became the head of the economics department at Chittagong University.

From 1993 to 1995, Yunus was appointed by the UN Secretary-General as a member of the International Advisory Group for the Fourth World Conference on Women. He was also a prominent member of the Global Commission on Women’s Health, the Advisory Council for Sustainable Economic Development, and the UN Expert Group on Women and Finance.

A well-known social entrepreneur, banker, and economist, Yunus is also hailed as the ‘father of microfinance’ for founding the Grameen Bank in 1983 and becoming the pioneer of microcredit and microfinance concepts.

The bank aimed at empowering the poor by providing small loans to help them become self-reliant. By providing small loans without any guarantees, known as microcredit, the bank introduced a revolutionary model for poverty alleviation worldwide.

In 2006, Muhammad Yunus and Grameen Bank were awarded the Nobel Peace Prize for their work to create economic and social development from below.

Inspired by the success of the Grameen Bank in Bangladesh, many other countries also adopted its model. Today, microcredit practices have spread to over 100 countries, including India, and developed ones like the United States.

Although Yunus was a well-known figure in Bangladesh, he had largely stayed away from the political arena.

However, he decided to venture into politics in February 2007 by founding ‘Nogarik Shakti’ (citizens’ power) and pledged to include only individuals with a “clean reputation” in the party.

Aiming at the 2008 elections, Yunus recruited prominent figures, including some renowned journalists, to his party. However, there were claims that his political venture had the backing of the military.

Hasina perceived Yunus as a political threat and, without directly naming him, stated that newcomers in politics are usually dangerous and should be approached with suspicion as they can do the nation more harm than good.

Just 76 days after founding the party, Yunus announced his exit from politics in May 2007.

In 2008, the Bangladeshi investigative agencies charged Yunus with over 200 cases of money laundering, embezzlement and forgery.

Hasina also accused him and the Grameen Bank of “exploiting” the poor by levying excessive interest rates.

Amid allegations, Yunus was compelled to resign as the Managing Director of the Grameen Bank, a move he claimed to be “politically motivated.” Subsequently, the Bangladeshi government intensified its oversight and control over the bank’s operations and management.

Yunus has also accused Hasina of destroying her father and Bangladesh founder Bangabandhu Mujibur Rahman’s legacy.

As Hasina flew out of Dhaka earlier this week, Yunus commented that Bangladesh is now a “free country.”

(IANS)