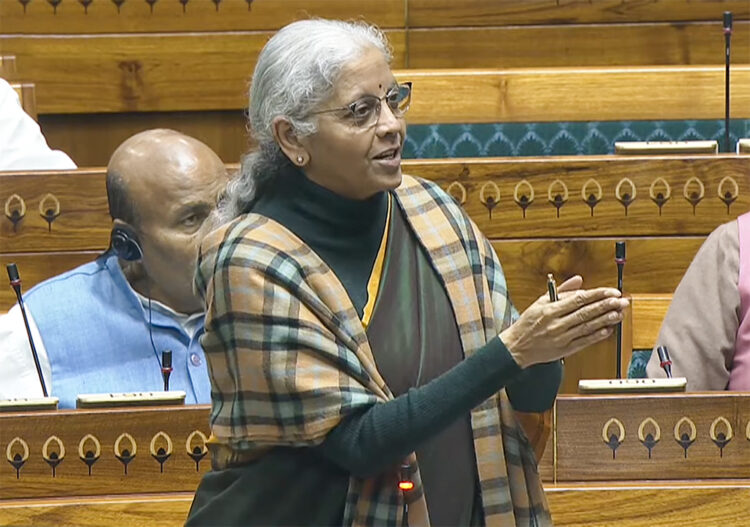

New Delhi: Finance Minister Nirmala Sitharaman on Thursday introduced the Securities Markets Code Bill, 2025, in the Lok Sabha, to consolidate, rationalise, and replace with a single law the three existing securities laws — the SEBI Act, 1992, the Depositories Act, 1996, and the Securities Contracts (Regulation) Act, 1956.

The Bill aims to provide a modern statutory framework for investor protection and capital mobilisation. It paves the way for enabling a participatory approach and consultative regulation while creating more awareness and drawing in more new participants.

The Securities Markets Code 2025 is a major milestone; a review of this scale in securities markets is happening for the first time, which will facilitate access to the investor and enhance capital mobilisation at a scale commensurate with the emerging needs of the fast-growing Indian economy, according to an official statement.

The existing securities law regime consists of three laws that were enacted decades ago. The three Acts have many overlapping and redundant provisions. The government, therefore, has decided to consolidate and rationalise these Acts into a Single Securities Markets Code (SMC), which endeavours to build a principle-based legislative framework to reduce compliance burden, improve regulatory governance and enhance dynamism of the technology-driven securities markets. This will promote ease of doing business, the statement said.

The language of the Code has been simplified to omit redundant concepts, remove the duplication of provisions, and incorporate consistent regulatory procedures for standard processes to ensure a uniform and streamlined framework of Securities Laws.

The Code seeks to strengthen the regulatory mechanism of the SEBI by expanding the board up to 15 members (from the existing 9 members, including the Chairperson), providing a transparent and consultative process for issuing any subordinate legislation.

It also seeks to eliminate conflict of interest by requiring the Members of the ‘Board’ to disclose any ‘direct or indirect’ interest while participating in decision-making.

Further, the code streamlines the enforcement procedure and ensures that all quasi-judicial actions are undertaken through a single adjudication process after an appropriate fact-finding exercise. The Code maintains an arm’s length separation between fact finding process, such as inspection or investigation and adjudication proceedings. It further lays down timelines for investigations and interim orders for a time-bound completion of the enforcement process. This will provide clarity and certainty on the regulatory action to the market participants.

As a significant progressive step, the Code also decriminalises the omnibus criminal provision and certain other contraventions of minor, procedural and technical nature into civil penalties to facilitate the ease of doing business and to reduce the compliance burden. Criminal offences are only provided for – (i) market abuse, (ii) non-compliance of quasi-judicial orders, and (iii) non-cooperation during the investigation.

The Code further seeks to strengthen investor protection, promote investor education and awareness, and ensure effective and time-bound redressal of investor grievances. It also enables an Ombudsperson mechanism for redressal of grievances.

It also enables the SEBI to establish a Regulatory Sandbox to facilitate innovation in financial products, contracts and services. Furthermore, an enabling framework is established for the inter-regulatory coordination of other regulated instruments to facilitate a seamless process for the listing of such instruments.

Besides, the Bill envisages putting in place a statutory framework to further strengthen the Securities and Exchange Board of India, facilitate more efficient securities markets, improve regulatory governance and strengthen investor protection, the statement added.

(IANS)