New Delhi: On the completion of 10 years of the Pradhan Mantri Mudra Yojana (PMMY), an expert on Tuesday said that the scheme has played a significant role in improving the financial condition of people across the country and has given a strong push to self-employment.

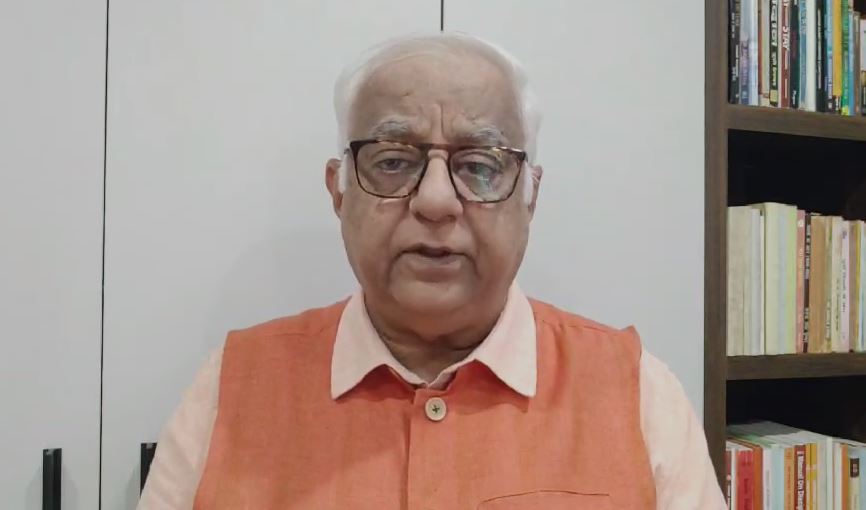

Ashwini Rana, founder of Voice of Banking, said that Prime Minister Narendra Modi launched the PM Mudra Yojana in April 2015 with the objective of providing financial support to individuals who wished to start their own businesses.

The scheme offers loans under three categories — Shishu, Kishor and Tarun. The Shishu category covers loans up to Rs 50,000, Kishor offers loans from Rs 50,001 to Rs 5 lakh, and Tarun covers loans between Rs 5 lakh and Rs 10 lakh.

Last year, the government also introduced a new category called Tarun Plus, which offers loans up to Rs 20 lakh.

“Over the past 10 years, 52 crore Mudra loans worth Rs 33 lakh crore have been disbursed under the scheme,” Rana said.

“This has helped improve the financial condition of millions and promoted self-employment on a large scale,” he added.

He also pointed out that women were given priority under the scheme, and apart from public sector banks, private banks and non-banking financial companies (NBFCs) also participated actively in the implementation of PMMY.

The non-performing asset (NPA) rate under the scheme currently stands at 3.5 per cent. On this, Rana explained that while NPAs are a common issue across all types of loans, in the case of Mudra loans, the government acts as a guarantor.

“As a result, if a loan turns into an NPA, the losses incurred by banks are compensated by the government,” he stated.

Calling it a successful initiative, Rana said, “PM Mudra Yojana has fulfilled all its objectives and continues to be a vital scheme for promoting entrepreneurship and financial inclusion in India.”

(IANS)