Kanniyakumari (Tamil Nadu): Seven months after India embarked on a path of ambitious renewable energy (RE) targets, questions about how equipped the power infrastructure is for the transition are hanging fire, especially in case of wind power.

As announced by Prime Minister Narendra Modi at the Glasgow COP in November last year, India has set an ambitious target of 500 GW of renewable energy by 2040 and 50 per cent of its requirement through renewable energy by 2030. As a step towards that, by the end of 2022, India has to achieve 175 GW of RE, of which 100 GW is to come from solar and 60 from wind power.

Media reports on Saturday said that states would now need to meet a quarter of their energy demands from RE sources under the new Renewable Purchase Obligation (RPO) and increase it to 43 per cent by 2030. In simple terms, this means that there is going to be an increasing share of RE among India’s total energy mix.

The moot question, therefore, is whether India’s power sector infrastructure is ready to adapt to this increasing share? Are the nuts and bolts in place for ensuring a smooth integration?

According to the Ministry of New and Renewable Energy (MNRE), India’s RE installed capacity increased 286 per cent in the last 7.5 years but it had a share of just 26.53 per cent in the total generation capacity.

One of the major reasons is lack of proper integration, not just in view of the upcoming, new installations but also for reviving the existing older infra, especially that of wind power. Majority of India’s renewable capacity additions come from solar and wind.

As against solar that is getting a large push currently, India has had wind power for over three decades now, that too majority by players. Therefore, the integration problems go hand in hand when it comes to new installations and repowering the old one. Especially, the old ones, so for, in the case of Tamil Nadu.

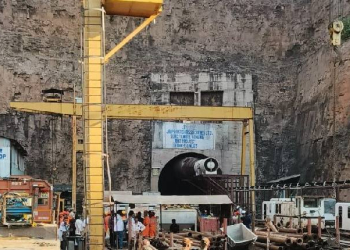

A visit to multiple windmill parks in Tirunelveli and Kanniyakumari districts, including Ramco’s at Muppandal with 235 machine units and Suzlon’s at Radhapuram with 519 machine units, and various villages that have standalone windmill units as part of a media workshop on Renewable Energy by Earth Journalism Network brought forth the problems faced by the wind power companies, problems that can hamper India’s leap into RE dependent future to bring down emissions as part of its action plan to combat climate change.

When the first windmill parks came about in the 80s and 90s, the turbines were of 250 KV or 800 KV and the tower on which those were installed were 30 metres or 50 metres tall and were erected in a grid pattern. The land required was calculated using the 5D X 7D formula, i.e. the distance between two units in a row and column depended on the height of the tower and length of the turbine blade.

By the turn of the century and then year by year towards 2022, the turbines’ availability increased to 1 MW, 2.5 MW, 3 MW, and 4 MW too. The tower height now can be 100 metres or 120 metres. For the wind power companies to migrate to higher technology, it is not just a question of money to replace turbines or increase the height of the tower, but a whole gamut of infrastructure overhauling is required.

“It starts with land required per unit. Farmers are willing to sell but demand much higher prices than existing. The larger the turbine, the larger the area per unit needed. Cost of replacing the existing units into newer, better efficient units includes the cost of civil work for the tower’s foundation, cost for increasing the tower height and replacing the turbine. Then, the transformer and transmission lines need to be upgraded to have the carrying capacity of higher power generation for power evacuation. Every single step in the process is costly and involves multiple authorities and stakeholders,” an official from one of the private companies told IANS during the field visit.

“The state government comes into picture where the power evacuation infrastructure needs an upgrade. It needs to be upgraded in sync with our end of upgrade. Else, it is a waste of time and resources,” said another official from another private company.

It is not that the Centre is not aware of the problems. In 2016 it came out with a repowering policy. “But it had a lot of issues. The micro-siting norms kept changing. The land availability is another major problem. The policy was such that bigger private companies can manage but not feasible for smaller units,” said Ajay Devraj, general secretary of Indian Wind Power Association (IWPA), a representative body from the wind power sector that has 1,400 members all over India, including 900 in Tamil Nadu alone. Its members generate as much as 26,000 MW of wind power, which is almost 62 per cent of the total.

“Government intervention is imminent to work out the land consolidation issues,” Devraj said.

Another problem is the power purchase agreements (PPAs) that these power companies have with the electricity boards (transmission companies) of respective states. States such as Gujarat and Maharashtra, which too have had wind power for over three decades now, have had shorter duration of PPAs. The companies there got higher incentives every time the PPAs were renewed. Unfortunately in Tamil Nadu, the PPAs signed in early 1990s were ended. That means, the companies are working at older rates. There are large pending dues from the state too.

“Selling to the electricity board must be the last option. There is a policy proposed that the private companies should sell only to the state, which would mean a much lower price compared to what companies would get if we sold directly to private industry as captive power. All that they would need to pay would be the wheeling charges,” said the first private company official.

However, there was no response from Tamil Nadu Generation and Distribution Corporation (TANGEDCO) to queries sent on phone, calls and even text messages by IANS. A senior official from MNRE, who is not authorised to speak with the media said: “The government is still fine tuning a lot of things, nothing is final as such.”

Industry experts also point out that the cost of replacing the older wind power unit with a new one comes close to Rs 1 crore per MW, an amount equivalent to get a new one. So the private power companies will not upgrade unless there are any incentives.

Francis Jayakumar, India director at the Global Wind Energy Council (GWEC), a non-profit trade association and an authoritative voice for the global wind energy industry, suggested that the Tamil Nadu government should come up with a clear policy about PPAs with existing private companies that have open ended arrangement from three decades ago.

“However, funds for upgrading infrastructure to evacuate additional power after repowering can be provided jointly by the Centre and the state. In fact, the Centre and the states should come up with clear policy as not all states have a policy for repowering. The MNRE should come out with such a policy and the CERC/SERC should implement those as regulatory frameworks.”

Sooner than later, the Centre will need to act on this. Unlike the solar power that is available over large parts of India, wind power is highly site specific and hence, available at limited places. The existing class I and class II sites (categorised thus depending on the efficiency in wind power generation at a given infrastructure level) have seen a saturation.

That leaves very little options for the government. More so, if it has plans to go big time on increasing RE share, including that of wind, as part of the clean energy transition.

(IANS)