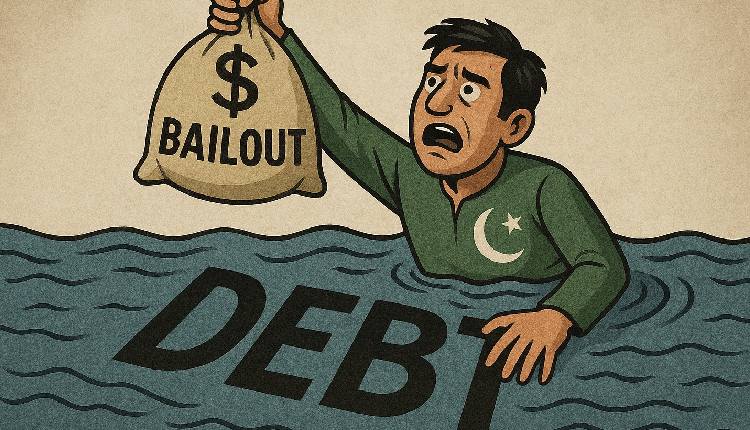

New Delhi: While multiple internal strife, a Taliban offensive at the Afghan border, and maintaining harmony with the powerful Pakistan Army are adding to Islamabad’s woes, the miserable economic condition has made it slide into deep debt.

Debtors, including China, reports suggest its total external debt has reached about USD 135 billion in Q2 2025, where the country already owes Beijing an estimated cluster of around USD 30 billion, with China being identified as one of Pakistan’s largest bilateral creditors.

Pakistan must meet over USD 23 billion in external debt repayments in the current fiscal year, and the central bank’s estimates put total foreign debt repayments and interest at about USD 30.35 billion for the year, say media reports.

As per the Pakistan Economic Survey 2024-25, the country’s total debt was Pakistani Rs. 76.01 trillion (approx. USD 267 billion) at the end of March this year, comprising domestic debt of Pakistani Rs. 51.52 trillion (approx. USD 180 billion) and an external debt of Pakistani Rs. 24. 49 trillion (about USD 86 billion).

There have been public concerns over such debts. Now, a desperate outreach to Washington appears to have helped it navigate to a favourable environment to unlock International Monetary Fund (IMF) support.

Lately, there has been a series of high‑level US engagements and meetings with financial officials coinciding with favourable decisions and public signalling of support.

As the largest stakeholder in the IMF, the United States arguably holds significant sway over lending decisions. The recent loan agreement coincidentally followed Pakistan’s diplomatic push in Washington, suggesting a coordinated effort to secure both political goodwill and financial backing.

Finance Minister Muhammad Aurangzeb held meetings with senior US Treasury officials, investors and multilateral institutions in Washington on October 13 and 14, where he pressed for investment and reform support.

According to officials, the ongoing outreach apparently aims to consolidate investor confidence, accelerate project implementation and strengthen financial partnerships.

Army General Asim Munir and Prime Minister Shehbaz Sharif have also been trying to cosy up to the White House.

On October 14, the IMF announced a staff‑level agreement on reviews under Pakistan’s Extended Fund Facility and the Resilience and Sustainability Facility, noting strong implementation and continued commitment by Pakistani authorities.

The staff-level agreement (SLA) is, however, subject to approval by the IMF Executive Board, according to Iva Petrova, who led an IMF team that held discussions with Pakistan between September 24 to October 8.

“Upon approval, Pakistan will have access to about US$1.0 billion (SDR 760 million) under the EFF and about US$200 million (SDR 154 million) under the RSF, bringing total disbursements under the two arrangements to about US$3.3 billion,” added Petrova in her statement.

SDR, or Special Drawing Rights, are an international reserve asset created by the IMF that serves as a supplement to the existing currency reserves of member countries, allowing them to exchange it for freely usable money when required.

Earlier, the IMF mission returned without signing the SLA with Islamabad, according to some reports that quoted unnamed sources.

In July, Pakistan and the United States concluded a tariff agreement that officials said reduced duties on Pakistani exports to 19 per cent.

Aurangzeb then welcomed what his ministry described as “successful negotiations with the US administration leading to a tariff deal” after meetings in Washington with senior US Treasury officials and investor groups.

Thus, Pakistan will need debtors’ nod for rollovers to manage repayments, mixing it with fiscal prudence, and more international financing.

(IANS)