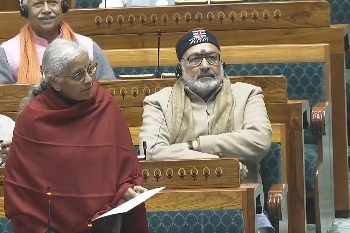

New Delhi: Union Electronics and IT Minister Ashwini Vaishnaw on Saturday said that Prime Minister Narendra Modi has given a big gift to common citizens in the form of next-generation GST reforms.

Praising PM Modi’s intention of extending benefits to middle and lower class families, the minister said that earlier, the income tax was exempted for earnings of up to Rs 12 lakh and now, the GST rationalisation will give huge relief to the lower-income groups.

The minister emphasised that the GST reform will provide a huge benefit to the country’s economic development.

“Our country’s GDP is Rs 330 lakh crore, to which consumption contributes nearly Rs 202 lakh crore. Following the GST reforms, if there is an increase of even 10 per cent, then consumption will increase by about Rs 20 lakh crore, meaning an additional GDP of Rs 20 lakh crore will come to the country, which is a significant increase in itself,” the minister stated.

The increase in consumption will lead to an uptick in employment opportunities, the minister added.

Many economic activities start increasing one after the other. This creates a virtuous cycle. Income tax exemption and the big decision of GST together will help in increasing the money in the hands of our middle-class families.

Earlier, the 56th GST Council approved the new-age GST reforms, simplifying the tax structure from a multi-slabs system into a primary two-slabs system of 5 per cent and 18 per cent, effective September 22, 2025.

The GST 2.0 reforms are aimed at reducing prices of essential goods and services more affordable, easing the compliance burden on businesses, and stimulating consumption-led economic growth. The earlier GST structure contained 4 slabs of 5 per cent, 12 per cent, 18 per cent and 28 per cent.

(IANS)