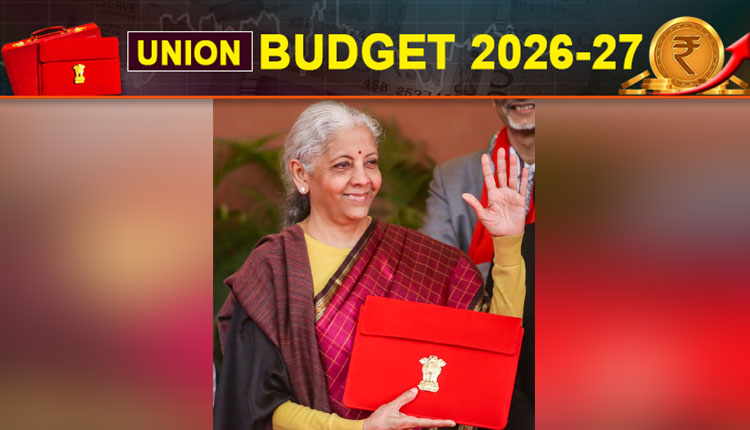

New Delhi: The Union Budget 2026-27, presented by Finance Minister Nirmala Sitharaman on Sunday, reflects the government’s vision of accelerating growth, strengthening resilience, and ensuring inclusive development.

It builds on over a decade of steady economic progress, combining reforms with targeted investments to boost manufacturing, infrastructure, energy security, and social welfare.

With record public capital expenditure, support for strategic sectors like semiconductors, bio-pharma, textiles, and rare earths, and measures to empower MSMEs, cooperatives, and rural enterprises, the Budget seeks to position India as a global leader in innovation and production.

At the same time, it prioritises ease of living, education, healthcare, and sustainability, balancing economic ambition with social responsibility.

India’s economy has recorded steady growth with low inflation over the past 12 years, driven by focused reforms under PM Modi’s government.

Key Highlights:

More than 350 reforms have been rolled out since Independence Day 2025, including GST simplification, Labour Codes notification, and rationalisation of Quality Control Orders.

Continued reforms in customs, indirect taxes, and direct taxation to improve ease of living and ease of doing business.

Ideas from the Viksit Bharat Young Leaders Dialogue 2026 shaped several proposals, making this a youth-driven budget.

Public capital expenditure (Capex) is set at Rs 12.2 lakh crore, the highest ever.

Effective Capex pegged at 4.4 per cent of GDP, the highest in a decade.

Special Assistance to states for Capital Investment (SASCI) increased by 23 per cent to Rs 1.85 lakh crore.

Launch of new Dedicated Freight Corridor from Dankuni (East) to Surat (West).

Operationalisation of 20 new National Waterways over the next five years.

Introduction of a Coastal Cargo Promotion Scheme to incentivise modal shift from rail and road.

Investment of Rs 20,000 crore over five years for Carbon Capture Utilisation and Storage (CCUS) technologies across five industries.

Development of City Economic Regions (CERs) with Rs 5,000 crore allocation per region over five years.

Creation of seven High-Speed Rail corridors: Mumbai-Pune, Pune-Hyderabad, Hyderabad-Bengaluru, Hyderabad-Chennai, Chennai-Bengaluru, Delhi-Varanasi, and Varanasi-Siliguri.

Integrated development of 500 reservoirs and Amrit Sarovars to boost fisheries growth.

Promotion of high-value agriculture: coconut, sandalwood, cocoa, cashew in coastal areas; almonds, walnuts, pine nuts in hilly regions.

Launch of the Coconut Promotion Scheme to replace old trees and enhance productivity.

Dedicated programmes for cashew and cocoa to achieve self-reliance and global brand competitiveness by 2030.

Rollout of Bharat-VISTAAR, an AI tool integrating AgriStack portals and ICAR practices for customised farm advisory.

Establishment of SHE-Marts for rural women-led enterprises as community-owned retail outlets.

Schemes for Divyangjan: Kaushal Yojana for livelihood opportunities in IT, AVGC, hospitality, and food sectors; Sahara Yojana for assistive devices.

Expansion of mental health infrastructure: new NIMHANS-2 in North India and upgrades to institutes in Ranchi and Tezpur.

Strengthening emergency and trauma care capacities by 50 per cent in district hospitals.

Boost for Purvodaya states and Northeast: East Coast Industrial Corridor with a node at Durgapur, five tourism destinations, and 4,000 e-buses.

Development of Buddhist Circuits in Arunachal Pradesh, Sikkim, Assam, Manipur, Mizoram, and Tripura.

Financial sector reforms: creation of a High-Level Committee on Banking for Viksit Bharat, review of foreign investment rules, and incentives for large municipal bond issuances.

Ease of Doing Business measures: expanded investment limits for Persons Resident Outside India (PROI) in listed companies.

Fiscal deficit for FY2025-26 retained at 4.4 per cent of GDP, consistent with the glide path to reduce below 4.5 per cent by 2025-26.

(IANS)