Bhubaneswar: The opposition Biju Janata Dal (BJD) on Thursday pressed for complete exemption of Goods and Services Tax (GST) on kendu leaf and handloom products, while also demanding that the Centre compensate Odisha for an estimated revenue loss of ₹1,000 crore per month due to recent GST slab revisions.

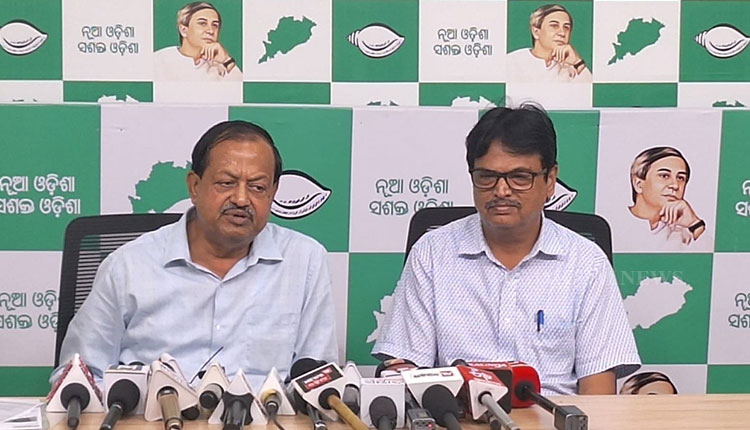

Addressing a press conference in Bhubaneswar, senior BJD vice presidents and former ministers Debi Prasad Mishra and Niranjan Pujari said that although the GST on handloom products has been reduced from 18% to 5%, it continues to burden poor artisans and weavers. Similarly, they noted that the reduction of GST on kendu leaves from 18% to 5% has failed to provide any real relief to tribal and dalit communities engaged in leaf collection.

The BJD leaders reminded that since 2018, the party has been demanding complete GST exemption on both kendu leaves and handloom products. Former chief minister Naveen Patnaik had also written multiple letters to Union Finance Minister Nirmala Sitharaman seeking exemption, but the request was not accepted.

“Tribal and poor workers engaged in kendu leaf collection get no additional benefits from the partial tax reduction. Likewise, handloom weavers, who belong largely to weaker economic sections and craft traditional cotton and silk sarees, remain disadvantaged. GST exemption is crucial to protect their livelihood,” Pujari, a former finance minister, said.

He further stressed that while the power loom sector benefits industrialists, the handloom sector depends on small-scale artisans. “Encouraging handloom products through tax exemption is a matter of social justice as much as economic policy,” he added.

The BJD leaders reiterated their call for the Centre to act immediately in the interest of lakhs of kendu leaf collectors and handloom weavers in Odisha.