New Delhi: Finance Minister Nirmala Sitharaman on Sunday announced a tax holiday till 2047 to any foreign company that provides cloud services to customers globally by using data centre services from India as part of the proposals in the Union Budget 2026-27 presented in the Parliament on Sunday.

The move is aimed at developing critical infrastructure and boosting investment in data centres. Those availing of the incentive will have to provide services to Indian customers through an Indian reseller entity, the Finance Minister said.

The Union Budget also provides for a safe harbour of 15 per cent on cost in case the company providing data centre services from India is a related entity.

To harness the efficiency of just-in-time logistics for electronic manufacturing, the Finance Minister proposed in the budget to provide a safe harbour to non-residents for component warehousing in a bonded warehouse at a profit margin of 2 per cent of the invoice value. The resultant tax of about 0.7 per cent will be much lower than in competing jurisdictions.

Besides, in order to give a fillip to toll manufacturing in India, the Finance Minister has proposed to provide exemption from income tax for 5 years, to any non-resident who provides capital goods, equipment or tooling, to any toll manufacturer in a bonded zone.

The Budget proposals also provide an exemption to the global (non-India-sourced) income of a non-resident expert, for a stay period of 5 years under the notified schemes. This is intended to encourage a vast pool of global talent to work in India for a longer period of time

It also proposes to provide an exemption from Minimum Alternate Tax (MAT) to all non-residents who pay tax on a presumptive basis.

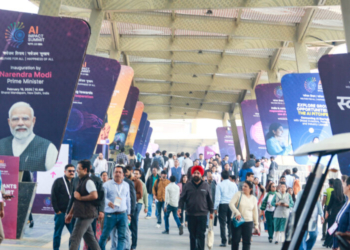

The Finance Minister in her speech stated that the Budget aims to sustain the moment of structural reforms, continuous, adaptive and forward-looking and for “cutting edge technologies, including AI, which can serve as growth multipliers”.

(IANS)